Are you a rental property owner feeling the pinch of taxes on your rental income? Or perhaps an unincorporated business owner seeking vital tax advantages? Discover a strategic tax strategy to drastically cut your tax bill and even accelerate paying off personal debts, like your home mortgage!

This powerful financial maneuver is the “Cash Damming Strategy,” designed to make your debt work smarter for you, creating significant tax savings.

What is the Cash Damming Strategy? (Simple Explanation)

Normally, interest on your personal home mortgage isn’t tax-deductible. However, interest on money borrowed specifically for business or income-generating property expenses is deductible.

Cash Damming is a clever tax strategy that converts non-tax-deductible personal debt into tax-deductible business or investment debt. This directly boosts your tax savings.

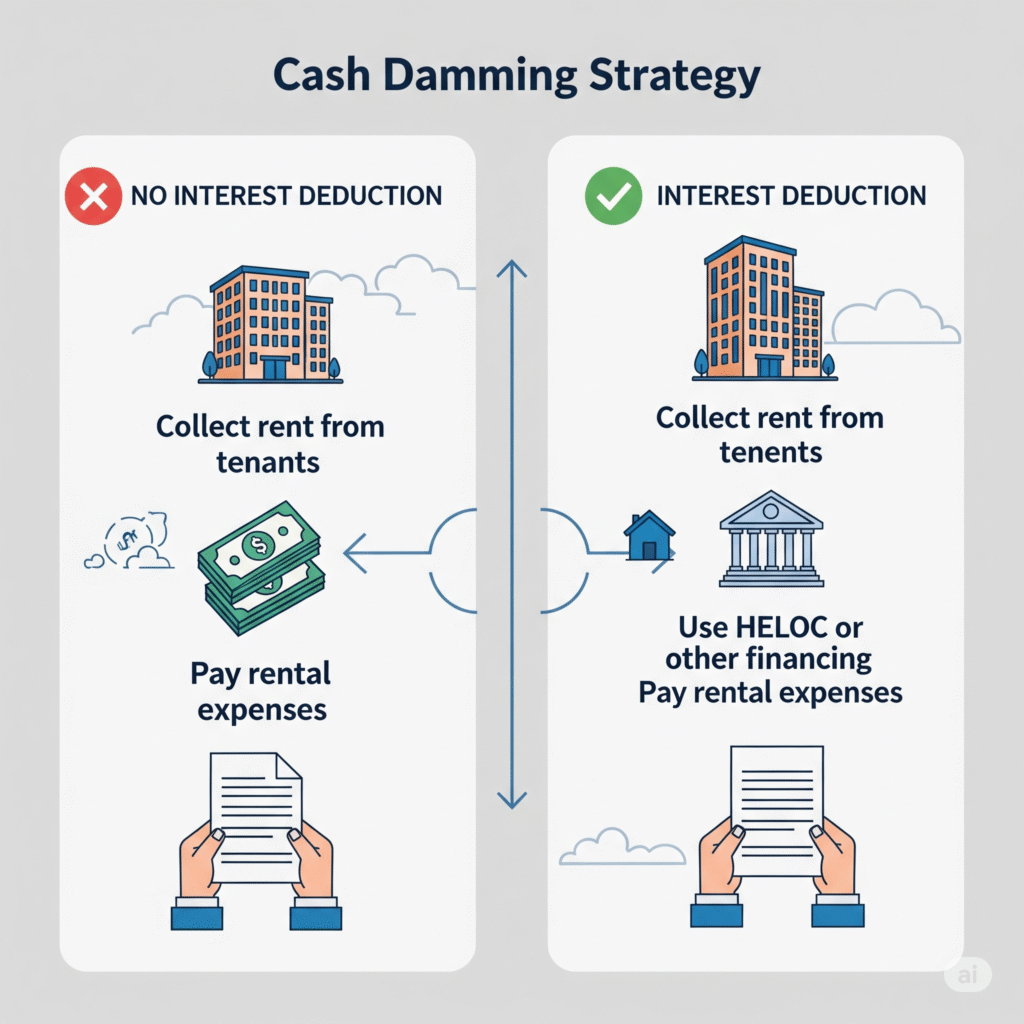

Let’s compare two scenarios for your rental income or business earnings:

1. No Interest Deduction (The Usual Way)

- You collect rental income/business earnings.

- You use this income directly to pay rental/business expenses.

- You use other personal money to pay your non-deductible personal mortgage.

- Result: No tax benefits from your mortgage interest.

2. Interest Deduction (The Cash Damming Advantage)

- You collect rental income/business earnings.

- You use this income to make extra payments on your personal mortgage (or other non-deductible debts), speeding up repayment.

- You then use a Home Equity Line of Credit (HELOC) or other financing to pay your rental/business expenses.

- Result: The interest on the HELOC (used for income-generating activities) becomes tax-deductible, significantly reducing your taxable income and boosting your tax savings!

How This Tax Strategy Works Step-by-Step

To make Cash Damming an effective tax-saving strategy, strategic account setup is key:

- Separate Your Income: Deposit all rental income/gross business revenue into a specific account.

- Accelerate Personal Debt Payments: Use this income to pay down non-deductible personal debts (e.g., home mortgage).

- Fund Expenses with Borrowed Money: Pay all rental/business expenses from a separate account linked to a Line of Credit (like a HELOC).

- Track Carefully: Maintain meticulous records to prove borrowed funds were used for income-generating activities – crucial for maximizing your tax deductions.

This method enables rapid personal debt reduction while creating tax-deductible debt, leading to substantial tax savings and improved debt management.

Who Benefits Most from Rental Income Cash Damming?

This powerful tax strategy is ideal for:

- Rental Property Owners: Especially those with properties in their personal name receiving rental income.

- Unincorporated Business Owners: Sole proprietors or partners seeking smart tax strategies.

Important Considerations for This Tax Strategy

While Cash Damming offers great tax advantages and tax savings, it’s a sophisticated financial strategy:

- Readvanceable Mortgage/HELOC: Optimal with flexible financing that allows re-borrowing as principal is paid.

- Meticulous Record Keeping: Essential for tax compliance and validating tax deductions.

- Long-Term Strategy: Benefits and tax savings accrue over several years.

Ready to Unlock These Tax Savings for Your Rental Income?

Understanding and correctly implementing the Cash Damming Strategy can lead to significant tax savings and faster debt repayment for rental property owners and unincorporated businesses. Due to its complexities and precision required, seeking professional advice is highly recommended.